Last Updated : Dec 27, 2018 12:51 PM IST | Source: Capitalmind

RBI is hoarding too much capital and can pay a chunk to the govt: Deepak Shenoy

If institutions like RBI hoard excess capital, that means the government will keep increasing our taxes for revenue.

Moneycontrol Contributor@moneycontrolcom

Deepak Shenoy

Capitalmind

The government’s asking the RBI for money, and saying it has too much capital. The conversations around this are of this sort:- Oh man the government is undermining the RBI independence by taking away its money

- The government will steal all the reserves from RBI.

- This is a

ploy to reduce the fiscal deficit

But let’s look at what it all really is. In a simplified format.

What’s the funda?

The government wants a piece of what RBI has been squirreling away for years out of its profits. We’ll examine why.

RBI makes a profit. It invents money. Mostly out of thin air, but given it’s in Mumbai, the air is more likely to be thick.

Haha. But really, how does it make money?

It makes money when banks take rupees from it through the “repo” window, for an overnight transaction. So, technically it prints money and earns interest on it, and then takes that money back in. This is called Seigniorage but if we’re changing city names can we please do something about such terms also. It might lose money as well, if banks don’t borrow from it and instead, park money with it and ask for reverse-repo interest.

Every rupee printed is a liability for the RBI – even in rupee notes, you’ll see the "We promise to pay the bearer the sum of…" – it’s a note saying the RBI owes you money. An asset for you, a liability for the RBI.

Wait. If the printed rupee is a liability, where are the assets?

Now the asset side contains, partly, government bonds – they pay interest. That interest is a profit for the RBI. (FY18 – they had about 6.9 lakh crore worth of government bonds, and made about Rs 48,000 crore as interest from that alone).

Also on the asset side is massive set of forex reserves. There’s also interest from “foreign” sources – they own US treasury bills/bonds as their forex holdings. Even if that pays 1%, they have $400 billion, so they’ll made around $4 billion a year. Last year, they made about Rs 23,000 crore from that too.

This adds up to a lot of money – in FY18, they made Rs 78,000 crore in income.

How much of that is profit?

The RBI doesn’t really need to spend money. It does pay salaries of about Rs 3,800 crore and spends on printing of notes (about Rs 5,000 crore), and then pays some commissions. If you add all of that up, it’s not too much in comparison.

In FY18, RBI spent about Rs 14,000 crore in the year.

And then they added some “provisions” of 14,000 crore more. So they spent 28,000 crore including provisions. And then said the profit after that was 50,000 crore and paid it out to the government.

Why’s the government cribbing? It got its 50,000 crore, no?

Because it’s not apparent why the RBI should be putting so much in “provisions”. But first, let’s take a look at the RBI Balance Sheet:

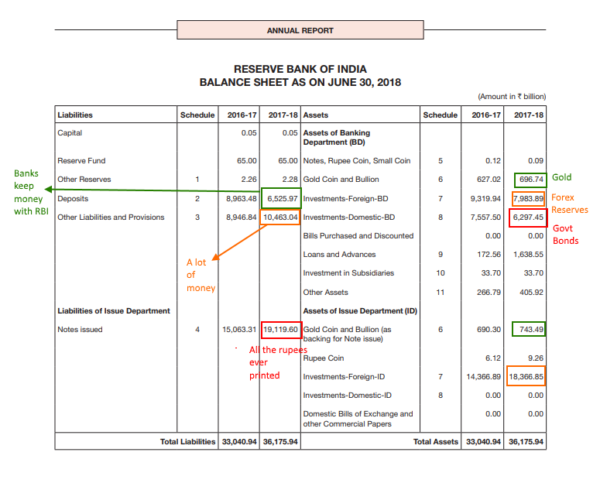

As you can see, the forex assets, gold and rupee government bonds are on the asset side of the balance sheet, which is about Rs 36 trillion, or Rs 36 lakh crores.

The liability side consists:- all the rupees ever printed (about 19 lakh crore)

- bank deposits as banks are required to keep CRR with RBI (Rs 6.5 lakh crore)

- and then a set of “provisions” (Rs 10 lakh crore)

It’s the provisions that are the niggling problem.

Why? What’s in the provisions?

See this.

Basically, the provisions are for:

a) S*** happens to the US Dollar which we hold in massive quantities and the rupee appreciates so we have this Currency and Gold Revaluation Account.

b) S*** happens to Gold in terms of it falling in price so much that we need a reserve, so look at a) above.

c) Interest rates in India go up big time and rupee bonds have losses – so the IRA-RS account applies.

d) India owns some US Bonds which can lose money if marked to market. Those losses should be in the IRA-FS account but are actually put inside of the Contingency fund. (Weird accounting)

Oh so it’s just a provision against losses? Why is that a problem then?

Just saying it’s a provision against potential losses doesn’t mean you can keep putting money in that thing forever and make it balloon to a ridiculous size.

I can tell you that you need to have something for a rainy day. That doesn’t mean you buy an umbrella factory.

This is like an RBI umbrella factory?

Think about it. Why do you need 10 lakh crore set aside for provisions? That’s just ridiculously high.

Look at the contingency fund. It has 232,000 crore rupees.

This gets hit when there are losses on the foreign bonds we hold, for example. But how much is that? In the last year, as the US raised rates, the loss was a miniscule 17,000 crore rupees. Even if we tripled that, the loss would be 50,000 crore at most.

This also gets hit in some cases when rupee interest rates rise, hurting rupee bond prices that the RBI holds. This is perhaps a larger amount, say Rs 75,000 crore required as a provision. At best, these two add up to about Rs 130,000 crore as provisions.

Then why do we have a massive Rs 232,000 crore in it?

We actually added Rs 14,000 crore to this fund this year. Why?

Sounds large. But there’s also nearly Rs 700,000 crore in some Currency Revaluation Account, too?

Yeah. That’s because if the RBI buys a dollar at Rs 70 it records the dollar as Rs 70 on the asset side, and Rs 70 is the “rupees issued” part of things.

But if the rupee goes back to Rs 65 to a USD, what happens? On the Asset side, the dollar is worth Rs 65.

On the liability side, we have Rs 70 issued (RBI can’t just take it back because the dollar fell against the rupee) so instead have, on the liability side:- Rs 70 issued

- MINUS Rs 5 as part of “provisions” in the Currency Revaluation Account (CRA).

- Adding up to Rs 65, equals the dollar on the asset side.

If the Rupee goes to Rs 75 to a USD, the CRA is increased.

The increase of CRA – because the dollar has gone this far – has been so much that the CRA has nearly Rs 700,000 crore in it.

Do we really need that much? We have about $400 billion in reserves. The reserve would make sense if the rupee rose 25 percent in a very short time, which is reasonably unlikely. (It’s fallen that much – hasn’t been allowed to rise anywhere close)

We could easily do with much lesser. Even taking 10 percent off, that would be excess provisions of Rs 70,000 crore on this account.

What else?

There’s an asset development fund of Rs 22,000 crore. It’s not apparent what the RBI might want to build, but holding 22,000 crore as a provision against that sounds a little excessive.

Wait, so how much excess does the RBI have?

Depends on who you ask.

Wha…?

Because if you ask RBI, they get all antsy and say there is no excess.

If you ask the government, they start cribbing about how RBI is getting antsy.

If you ask me, I’d say around Rs 300,000 crore seems to be excessive – from various provisions.

So can the RBI give it back?

Of course. But it can’t just give it back by printing rupees. That would be silly. Because printing rupees means you increase your liabilities. We want to REDUCE them.

So what you do is:- On the liability side, you reduce the provisions by a certain amount

- On the asset side, you cancel out some government bonds. What the government owes the RBI (as interest and principal) goes away into thin air.

This gives government the ability to issue more bonds (since it just saved a truckload on interest costs) and thus use that additional money to do different things.

But its unlikely to happen in a year. At best, there would be a Rs 30,000 crore to Rs 50,000 crore extra payout every year for a few years. That’s also decent enough.

You’re saying this is good?

It is good.

Because the government is the real contingency owner here. When banks are in trouble the government has to bail them out, not the RBI.

Why should the RBI hold all those reserves then? It’s excessive, and almost irrational to do so. This money is better off with the government, even though many people think no money is ever better off with the government.

You could compare this with other countries too – but even the US Fed has $66 billion of losses in its holding of US government bonds, which would completely wipe out its capital (of $39 billion). But it chooses to not mark to market. There are countries that limit the size of the central bank balance sheet. Many say that if the net worth turns negative, the central government should recapitalize the central bank immediately.

These are definitely options, but it’s best if we limit the “contingency” and “revaluation” reserves to a much lower number than the current 28% of balance sheet. All tax payers must demand this – if institutions like RBI hoard excess capital, that means the government will keep increasing our taxes for revenue.

So we can expect a cut in taxes if RBI pays?

That’s a whole different ball game. Let’s just put it this way: the pecking order is:

Priority 1: PSU banks that need recap

Priority 1: Farmer loans that must be forgiven

Priority 2: Air India and other loss making PSU thingies.

…

Priority 647: Cutting taxes.

So yeah, you could expect it if you want.

Source: Capitalmind

First Published on Dec 27, 2018 12:51 pm