Mutual Credit, the Astonishingly Simple Truth about Money Creation

Mutual Credit is the way money is created in barters worldwide. Barters don’t barter. They don’t use national currencies to finance their trade and that’s why they are called that way. But they use their own means of exchange to pay each other, so ‘barter’ is a misnomer.

It is an extremely cheap and simple way of creating money. Every participant is given an account and credit. Let’s say 1 Unit = 1 Dollar. This is actually how many of these systems work: it creates transparent pricing by using the national currency as the unit of account, but not as a means of exchange.

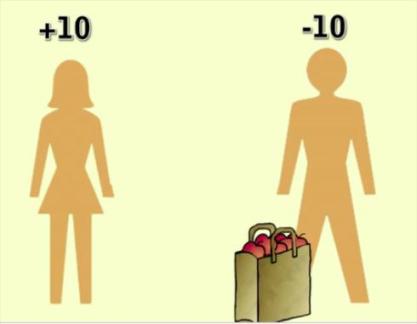

Let’s say every participant gets a 1000 Unit credit. In the beginning there is no money at all. It only comes into circulation when one of the participants uses his credit to pay another participant. If he uses his 1000 Units his balance is – 1000 U. His supplier’s balance is now +1000U. The total amount in circulation is now also 1000 U. This means there is always exactly as much in circulation as there is outstanding credit: a zero sum game.

If you understand the very primitive LETS, you basically understand how money should work. It really is that simple. Galbraith was not kidding when he said “The study of money, above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to reveal it. The process by which banks create money is so simple the mind is repelled. With something so important, a deeper mystery seems only decent”.

But there is no deeper mystery. This is it.

But there is no deeper mystery. This is it.

One of the key reasons why privately operated barter units are not dominating in the real economy, is because until recently there was no known mechanism to create convertibility to other units, most importantly the national units. Amazingly, many of these barters actively resist convertibility and believe non-convertibility is a strength. It is not, of course, as it hinders the liquidity of the unit.

Lately, however, the right way to convertibility has been shown by Bitcoinand the Gelre: on-line markets where the units can be traded in a free market environment is the solid way forward.

Lately, however, the right way to convertibility has been shown by Bitcoinand the Gelre: on-line markets where the units can be traded in a free market environment is the solid way forward.

Let’s explore a number of items to elucidate the matter.

1. Zero reserves are required

Therefore, the Mutual Credit Facility (MCF) does not need savers. It does not need to attract outside capital. It does not incur capital costs in creating credit. It can therefore operate interest free.

Therefore, the Mutual Credit Facility (MCF) does not need savers. It does not need to attract outside capital. It does not incur capital costs in creating credit. It can therefore operate interest free.

2. Mutual Credit Facilities typically finance themselves with monthly fees. These can be very low, about 10 dollars a month. Of course the outlet does need a minimum numbers of participants to be effective and acquire sufficient income to operate. But with only a thousand firms participating, already a viable business is possible.

3. Governments can easily create National Currencies using Mutual Credit. Commonwealths on other levels can do so too.

4. Debts that are not repaid lead to unbacked units in circulation. The cost for taking these out of circulation can be covered by taking a small one off fee when the credit is assigned. Defaults typically amount to 2% of total outstanding credit.

5. Serious sums of credit are backed by collateral.

6. The creditworthiness of participants is much higher than with banking, because debtors are not burdened with interest.

7. In the case of payment problems, Mutual Credit Facilities will typically not act in the same barbaric ways that banks do. The debt does not grow if repayment is lagging, because there is no interest. If a debtor defaults, underlying assets will be liquidated, but in the way least harmful to the debtor.

8. The MCF is intrinsically stable: it cannot provide more credit than it has assets, because it has no assets. Even if the MCF goes bust because it cannot finance its own operation, all the outstanding debts will be repaid and settled in other currencies. People holding the defunct units can expect to be (almost) fully reimbursed, even though this may take some time.

9. MCFs should preferably be Not for Profit entities. But commercial MCFs certainly are possible too.

10. There are no laws to stop Mutual Credit in the marketplace. But of course regulators are inimical to them.

11. MCF units can have their own unit of account (like with LETS), or they can use the National Unit as such.

12. MCF units are a means of exchange and should never be hoarded. They should be converted to other currencies, precious metals, durable goods, invested or used in other ways when people want to store wealth.

13. Mutual Credit is peer to peer. The MCFs exists only to see to the administration it brings. It is fundamentally democratic.

It is in this incredibly simple way that humanity can finance itself interest free. We can get rid of interest, not by outlawing it, but by creating all the cash we will ever need at zero cost.

We don’t need interest, there is no economic need for it and fully functional ways of creating credit without it are available now.

It will make obsolete capital markets, speculation, and exploitation through artificial scarcity. It ends the losses to inflation. It allows decentralized control of the economy.

It only needs growing awareness and dedicated people to implement it.

No comments:

Post a Comment