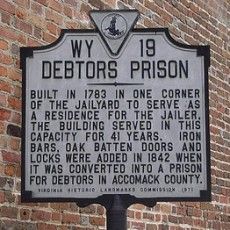

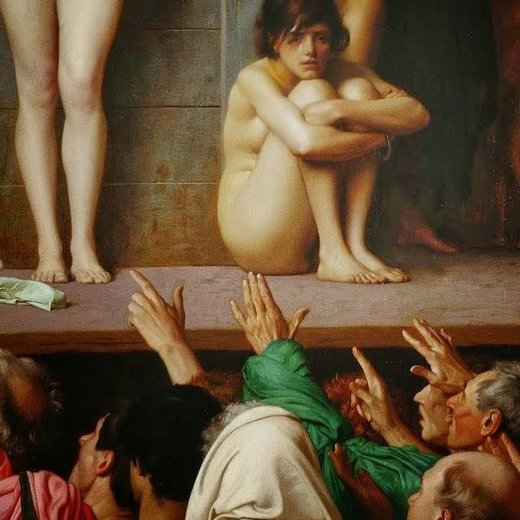

Federal imprisonment for unpaid debt has been illegal in the U.S. since 1833. It's a practice people associate more with the age of Dickens than modern-day America. But as more Americans struggle to pay their bills in the wake of the recession, collection agencies are using harsher methods to get their money, ushering in the return of debtor's prisons.

NPR reports that it's becoming increasingly common for people to serve jail time as a result of their debt. Because of "sloppy, incomplete or even false documentation," many borrowers facing jail time don't even know they're being sued by creditors: More than a third of all states now allow borrowers who don't pay their bills to be jailed, even when debtor's prisons have been explicitly banned by state constitutions. A report by the American Civil Liberties Union found that people were imprisoned even when the cost of doing so exceeded the amount of debt they owed.

Sean Matthews, a homeless New Orleans construction worker, was incarcerated for five months for $498 of legal debt, while his jail time cost the city six times that much. Some debtors are even forced to pay for their jail time themselves, adding to their financial troubles.

Stories of surprise arrests for unpaid debt have been reported in states including Indiana, Tennessee and Washington. In Kansas City, one man ended up in jail after missing only a furniture payment. The Federal Trade Commission received more than 140,000 complaintsrelated to debt collection in 2010, and they've taken 10 debt collection agencies to court for their practices in the past three years.

Since the start of 2010, judges have signed off on more than 5,000 arrest warrants since in nine counties alone. Beverly Yang, a legal aid attorney, says many debtor's - and judges -don't know debtor's rights, which results in the accused being intimidated into a pay agreement. She's seen judges interrogate debtors about why they can't pay more and whether they are trying hard enough to find a job.

Yang says some collection agencies are only too eager to use needlessly harsh tactics. "Whatever the creditors or the creditors' attorneys can do to leverage some kind of payment, it will help their profits enormously because they have, literally, millions of these." Debt collection is a lucrative business - the industry is set to grow 26 percent in the next three years.

NPR reports that it's becoming increasingly common for people to serve jail time as a result of their debt. Because of "sloppy, incomplete or even false documentation," many borrowers facing jail time don't even know they're being sued by creditors: More than a third of all states now allow borrowers who don't pay their bills to be jailed, even when debtor's prisons have been explicitly banned by state constitutions. A report by the American Civil Liberties Union found that people were imprisoned even when the cost of doing so exceeded the amount of debt they owed.

Sean Matthews, a homeless New Orleans construction worker, was incarcerated for five months for $498 of legal debt, while his jail time cost the city six times that much. Some debtors are even forced to pay for their jail time themselves, adding to their financial troubles.

Stories of surprise arrests for unpaid debt have been reported in states including Indiana, Tennessee and Washington. In Kansas City, one man ended up in jail after missing only a furniture payment. The Federal Trade Commission received more than 140,000 complaintsrelated to debt collection in 2010, and they've taken 10 debt collection agencies to court for their practices in the past three years.

Since the start of 2010, judges have signed off on more than 5,000 arrest warrants since in nine counties alone. Beverly Yang, a legal aid attorney, says many debtor's - and judges -don't know debtor's rights, which results in the accused being intimidated into a pay agreement. She's seen judges interrogate debtors about why they can't pay more and whether they are trying hard enough to find a job.

Yang says some collection agencies are only too eager to use needlessly harsh tactics. "Whatever the creditors or the creditors' attorneys can do to leverage some kind of payment, it will help their profits enormously because they have, literally, millions of these." Debt collection is a lucrative business - the industry is set to grow 26 percent in the next three years.

Comment: Related articles: