Keith Weiner Economics

The official site of the economics work of Keith Weiner, PhD

Look Beyond Supply and Demand to Understand Labor

3 Replies

We’re all familiar with the Law of Supply and Demand. There is a supply curve that goes up as price goes up, and a demand curve that goes down as price goes up. It’s often drawn like this:

Using this idea, one would expect immigration to cause wages to fall. It seems obvious. Increasing the supply of labor will push the equilibrium price down. Won’t it?

Not so fast. At best, Supply and Demand is an approximation. If the market were frozen in time and all variables were somehow fixed except supply, then sure, a rising supply of workers would cause a falling price of labor. Maybe. I call this kind of thinking the most common economic error. Just how are we to freeze the economy the way a camera freezes a scene, and yet change that very economy by adding more workers?

There is no such thing as Economic Photoshop.

Static thinking is tempting because it’s easy and seems to appeal to common sense. To borrow a phrase coined by Wolfgang Pauli, it’s not even wrong.

As with every kind of aggregate quantity that economists like to measure, supply and demand are not forces that impel market participants. Hiring managers don’t input the quantity of workers into an equation, and get the wage from that. They’re concerned with something quite different, and much easier. They want to make a profit.

Suppose a worker can make 10 hamburgers an hour. The non-labor costs add up to $3.50, and the customer is willing to pay $5.00. A simple calculation tells the manager that a worker will generate $15.00 per hour ($5.00 – $3.50 = $1.50 x 10). He therefore cannot pay more than $15, or even close to that. He has to offer at least $8 to attract workers. That leaves him a tight profit margin because there are work breaks and slow times during the day.

The supply-and-demander will at this point demand, “well if you add more workers competing for the same job, won’t the hiring manager be all too happy to pay less than $8?” That’s the same fallacy I described above. It presumes that we can hold constant the number of restaurants, burger-eating consumers, and even the percentage meals people eat out. We cannot presume that we can change only the number of workers.

Labor doesn’t work as the so called Law of Supply and Demand predicts. America once had by far the greatest immigration, and at the same time it had by far the fastest wage gains. To understand why, we have to look at what supply demand is trying to approximate.

Marginal utility.

Let me explain. The first unit of a good is bought by the consumer who places the highest value on it. For example, bakeries have long bought wheat to make bread. No higher use of wheat exists than eating it. We need food to live.

When farmers increased efficiency and output, then pet companies could put wheat into dog food. With further price cuts, home decor companies could put wheat into wallpaper paste. As it gets cheaper still, toymakers could make it into a sculpting material for toddlers. And so on (these examples are just my suppositions, so take then with a grain of salt).

The price of wheat is set by this marginal user, because that’s the buyer who will walk away on the first uptick. In other words, the price of wheat is what the maker of Play-Doh can afford to pay.

If farmers can produce even more and sell it to the market, who knows what the next lower use of wheat is? Maybe someone will make recyclable boxes out of it.

The principle for every commodity is the same. As more is produced, the price has to drop to accommodate the next lower use. The marginal utility of wheat declines. So does the marginal utility of copper, crude oil, iron ore, and every other commodity (except gold, but that’s a whole ‘nother discussion).

People say that the price has to fall to find a new equilibrium on the demand curve, but they do not see the cause, declining marginal utility. They see only the effect.

This brings us to human labor. Is work like wheat, descending from high uses to ever-lower uses?

No.

The exact opposite is true. Before the Industrial Revolution, the vast majority of people worked as laborers in agriculture. The work was not only back-breaking, but offered very low value. Ever since then, developed economies have employed more and more people. But they are not employed in lower and lower jobs for them (question: what’s lower than mucking out a stall for a horse?) They are employed in higher and higher jobs. Work is so advanced today, we produce such high value products, that people from the 18th century could not have even imagined it.

The marginal utility of human work does not diminish, as the number of workers increases. As the size of a market grows, the value of firms and workers within it rises.

Why Does the Left Support Wall Street?

The rhetoric from the Left is intransigent in its denunciation of wealth. As long as someone is wealthy, there is inequality. This is because there has always been and will always be someone who is poor. So the very existence of a rich man serves as a rebuke to the Left’s worldview, and a fly in the social justice ointment.

However, Leftists in power behave differently than their rhetoric would lead us to expect. They enact legislation and regulation which actually helps enrich crony businesses, such as big banks. The common refrain is that these politicians are corrupt, and on the take. Wall Street is simply buying their favor.

While this is true to some extent—certainly Wall Street spends a lot on lobbying—it’s not a satisfying answer. How do we fully explain the seeming anomaly between ideas and action on the Left?

It is no anomaly at all. To see why, look at it from the Left’s point of view. It has to be frustrating when the voters reject the policies of Marxism. Unlike in many other parts of the world, the American people do not hate wealth—not yet. If you were a Leftist, how would you go about changing this?

Even today, many Americans if not most of them, feel at a basic gut level that if you work hard you can get rich, and you deserve it. The Left has to find a way to undermine this. The Left wants to migrate Americans to the attitude held in socialist countries: the feeling that if someone is rich then he must be on the take.

If you wanted to devise a strategy to get the population on board your socialist agenda, I can think of no better way than to create a class of very rich people who get their riches off the backs of the people. Create thousands of real-life fat cats whose villainy is infamous. Show the people that this is what it means to be rich: to be on the take. That the rich do not produce, but amass a fortune at the expense of others, at your expense. Put that in the public spotlight.

Once the voters believe this, deep down in their hearts, it’s over. The free market is done. Stick a fork in it. Support for the rights of property or contract will fade away. Then, the path is paved for some kind of socialist takeover and totalitarianism.

Reflections Over 2015

This has become an annual tradition of mine, to blog about my year. My reflections posts are longer than most, and less structured. They are offered for those who may be interested. Let me begin this year’s musing with a story which I’ll then tie into my observations over the course of the year.

There are two sides to the Fed debate. One side wants to centrally plan our dollar with discretion. The other wants central planning based on a policy rule, such as a steady rate of inflation or GDP. I have an observation: this is a false alternative. The real debate should be central planning vs. free markets.

Both sides of that false alternative commit the same simple error.

It likely begins, in the second or third semester of undergraduate economics. Picture a student, all full of himself, armed with just enough knowledge to be dangerous. Failing to grasp what motivates market participants, he thinks in simplistic, aggregate terms. He sees two men and two steak dinners and writes an equation about “maximizing dinner utility”. He cannot even imagine that one is fat and eating two meals, while the other goes hungry. He treats economic statistics as if they constituted reality.

Failing to understand cause and effect, he thinks the government can achieve an effect by manipulating anything that correlates with it. For example, credit correlates with economic growth. Our sophomoric sophomore has no understanding of the economy, economic actors, growth, or even the difference between money and credit. He just feels that the government can make growth if it increases the quantity of dollars.

In a proper economics course, the professor would spend 10 minutes showing this young fool the folly of his foolish notions. But, alas, the young fool spends the remainder of his four years in college hardening his views. He goes on to write a dissertation, formalizing his errors. And he gradually becomes an old fool, dedicating his career trying to impose his foolery on everyone else.

I saw this false alternative again and again over the course of the year. It played out in the Jackson Hole Summit (at which I spoke, using the analogy of cherry flavored cyanide vs. strawberry flavored cyanide). It was the focus of the Cato Monetary Conference, which I attended in November.

It’s bizarre that the most strident critics of the statist central banking regime agree with its propagandists. Yet in monetary matters, that’s what we see: two schools competing on how to advise the central bank to centrally plan credit, and hence the economy.

And nearly everyone passively accepts that the chief danger is rising prices. Since we don’t haveinflation now, the critics have effectively conceded to the regime the right to continue monetary planning. Hey, it’s not doing the one harm that they can understand.

Somewhere down in Hell, Marx (who included a central bank in his ten planks) is looking up at the world and smiling.

Meanwhile, back in reality, the debt goes on rising exponentially. The interest rate is falling worldwide (notwithstanding Yellen’s attempt to hike rates in the US, which I predict will be in vain). Falling interest is causing all manner of problems such as falling wages, rising asset prices, and falling profits. And it’s forcing the economy into liquidation mode. But hey, prices aren’t rising, so it’s all good right?

I am sure that the bondholders of commodity producers (and some commodity trading firms) might quibble.

Do I sound pissed off? Hell yeah!

The biggest obstacles to rediscovery of the gold standard are, in no particular order, the gold bugs, the gold conspiracy advocates, the gold standard advocates, and the sound money economists. The gold bugs show that what they really want is a high price for gold, so they can make profits—more of the dollars they earnestly tell you will be worthless by tomorrow morning. The conspiracy theorists repel normal people with their tinfoil hats. Many gold standard advocates want central planning based on the price of gold. Others want to prohibit banking as such, which is also central planning. The sound money economists teach that the value of a currency goes down as quantity goes up, and measure the value of a currency in terms of prices. In effect, they give the dollar a clean bill of health, a false sense of security.

A lot happened this year.

In January, I published a paper The Swiss Franc will Collapse. Amazingly, for a 6500-word economics paper based on balance sheet analysis, it went viral and was read by hundreds of thousands of people. It was well received in Switzerland. It generated some backlash here in America, though nothing substantive. I did not say the collapse would occur in 2016, but instead warned that the Swiss negative interest rate is irredeemable, and also lethal.

I also realized that we, the gold standard movement, need to reach out to constituencies that have not traditionally supported gold. For example, Democrats.

In February, I testified before the AZ House Federalism and States’ Rights Committee in support of HB 2173. This bill would have established gold and silver as legal tender, and removed capital gains taxes on the metals (which is just a tax on the falling dollar). It passed both Republican-majority houses, only to be vetoed by Republican governor Doug Ducey. Are you paying attention, Democrats? Gold is not exactly well loved by the Republicans.

In March I moved my column from Forbes, where it had been for a year and a half, to the Swiss National Bank and Swiss Franc blog. It has helped grow my audience internationally, and bring my work to the attention of central bankers in Switzerland and in many other countries. For example, my open letter to Greek Prime Minister Tsipras was translated into both Greek andRussian, and published in those countries.

In April, I introduced the concept of Yield Purchasing Power. I think this is one of the most important ideas I have had. I would like to see it become a household term as purchasing power is. Though I have as much ego as the next public intellectual, I say this because I think it’s that important. The epic collapse of yield purchasing power is unnoticed, a tragedy given the destruction it’s wreaking.

I also went to Texas to testify on behalf of their gold legal tender bill. Unfortunately, the bill did not make it out of committee.

In July, I spoke at FreedomFest. In August, I published my first article in the American Spectator, on the deadly intersection of securities regulation and drug regulation. I also spoke at the Jackson Hole Summit, an alternative to the Fed’s conference also taking place at the same time in the same town. The Summit was a bit more oriented towards free markets than the Fed event.

In September, I spoke in New York City, presenting for the first time in a lecture format my theory of interest and prices. I also presented it in London, Zurich, Sydney, and Auckland. It should be obvious that our times are not anything like the 1970’s, but it would be hard to tell that from the main criticism of the Fed’s post-2008 policies.

I also talked about Monetary Metals’ idea to offer interest on gold, paid in gold. Interest (no pun intended) was strong.

Also in Sydney, I gave a keynote at the Precious Metals Symposium. My topic was Yield Purchasing Power. I think I hit a note, as other speakers who followed me referenced my talk. I received some invitations to speak in Asia next year, and will announce these when details are firmed up.

After returning home from my around-the-world trip, I helped put on two events in what we hope will be a series. The first Monetary Innovation Conference was in Washington DC in November, and the second was in Phoenix. The latter will hopefully influence and inform the discussion of gold legal tender the state of Arizona going forward.

In December, I helped draft legislation that will (knock on wood) be introduced before the legislature in 2016, and soon after (knock on wood some more) be enacted into law. Stay tuned!

As I write this, I am working on plans for several new products for Monetary Metals.

2016 is looking like it will be an exciting year.

Efficient Malpractice

Take the notion of the efficient market. What does that mean? Today, hordes of people are coming out of economics and finance majors believing an absurdity. Yes, I said absurdity. They think that, if the market is efficient, it’s impossible to beat the average investor. This is based on the premise that stock prices (or commodity prices, bond prices, etc.) always incorporate all relevant information.

This means that it’s impossible to know something that others don’t know.

If that were true, then entrepreneurs could not exist, and central planning committees should decide how to best spend the collectivized resources. But it’s not so.

What everyone knows is sometimes false. For example, at one time people thought the world was flat. No matter how unpopular it may be, it’s always possible to discover the truth. When this happens in regards to the value of an asset, the discoverer can make money. This fact should be uncontroversial.

So how did it become controversial?

Part of the answer may be that the philosophy departments have long ago defaulted. It is accepted in the mainstream that knowledge is out there, literally in the universe. In this view, prices are right out there with knowledge.

Information, and more importantly understanding, only incurs in here—in your head. It takes an individual mind to process information, and form an understanding. This means that there is no direct transmission process from information to prices. It is a process of each individual mind coming into contact with the information, deciding for itself whether it even agrees and if so, what importance to ascribe to it. And then, and only then, whether to buy or sell.

Case in point, I can say that the information is out there that all fiat paper currencies eventually collapse. I have put some of that information out there myself. Does that mean that all market participants sell their fiat paper currencies and bid up the price of gold to infinity (or permanent backwardation) instantly? They haven’t done so yet.

Some people know how fiat currencies fail, but most people don’t. Price is set at the margin, so we can say that the marginal gold trader doesn’t know about fiat currencies. Or, it could be that he doesn’t care. The marginal seller could be a gold mining company with a lot of dollar-denominated debt. It will not stop selling gold, no matter what the CEO believes. If he does not sell the majority of the mine’s output, the company will be in default and the creditors will take over. Different actors in the markets have different motivations, let alone different knowledge.

So what on earth could efficiency mean? What could the original intent of this word have been?

There was a time, not too long ago, when a commodity could have a different price in different markets within a city. Communication was slow, and transportation even slower. Economists of the day were aware of this, and concerned about it. If wheat could be had for 4 shillings in the north of London, and 3 shillings in the east end, then many people were making an obvious mistake. Buyers in the north were overpaying, and sellers in the east were accepting too little.

Distributors entered the market. They developed ways of knowing the price in different places, and sought to profit by buying where goods were cheaper and selling where they were more expensive. The result of this activity was a price closer to 3 ½ shillings in both north and east London.

Suppose that wheat was trading higher in Scotland, but cheaper in France. This is the same problem, on a larger scale. It’s nothing that can’t be fixed by adding telegraphs, railroads, and boats.

Similarly, one might observe a wide spread in wheat. The bid might be 2 ¼, but at the same time the ask is 3 ¾. The market maker comes into the wheat market, ready to buy at the bid and sell at the ask. In so doing, he and his competitors narrow the spread. It could become a bid of 3 and an ask of 3 ¼.

Another kind of spread occurs across calendar time. Suppose the wheat harvest comes in, on August 1. The price of wheat collapses for a while. But bakers will still want this commodity next month, and every month through July next year. By late Spring, the price of wheat skyrockets. So warehousemen enter the market, able to buy spot wheat and sell forward contracts for future delivery.

Economists of the day might say that the wheat price reflected all available information. This does not mean that 3 ¼ shillings is right in any intrinsic sense. These arbitrageurs are not supposed to be omniscient. In fact, all they are doing is closing the price gaps they find, and earning a small profit to do so.

This is the original idea of efficiency. It had to develop, as these market innovations were occurring. Note that these have nothing to do with the belief that the current price represents the absolute or universally right price for wheat. Perhaps wheat demand will soon drop off due to a new diet. Perhaps the price will rise due to an insect working its way west out of Russia. These vague concerns have nothing to do with the arbitrageurs.

Efficiency in this original sense is a concept pertaining to the losses one will take to trade in and out, to buy at one’s preferred location, to buy when one chooses, etc. Efficiency exists when a variety of arbitrageurs are active in the market, able to close gaps of distance, spread, or even calendar time.

The arbitragers can be said, in an abstract sense, to be using information to impact prices. However, one should look past the abstract idea to the mechanics of where the rubber meets the road. The simple processes of arbitrage cannot provide the sort of guarantees in which today’s efficient market theorist believes.

The modern idea of efficient markets switches to an entirely different kind of actor. The speculator is no arbitrageur. The distinction is important, because arbitrage is a powerful lever than can narrow any spread. Speculation cannot do what arbitrage does. Speculation, subject to uncertainty, overshooting, undershooting, and risk, is a generally weaker and always inconsistent force than the lever of arbitrage.

Suppose Joe the speculator thinks that the price of wheat will collapse, because of the paleo diet. He and his buddies may sell wheat short, taking down the price. At the same time, Jen the speculator thinks that the price will rise due to some insect in Russia which is eating wheat. So when Joe is about done selling wheat down, she and her friends begin buying it up. Perhaps Joe and his buddies get squeezed, and are forced to buy wheat at a higher price, and their buying pushes up the price even further.

The result is that the price moves around chaotically. At no point in this maelstrom can we say that the price incorporates all information. Sure, Joe and his buddies have pushed the price down based on their diet theory. Then Jen and her friends push it up, leading Joe and his friends to (unintentionally!) push it up further. Next, it may be too high and now Bob and company can short wheat once more, to get the price down to what Bob calculates is the point where supply meets demand. Jen and her friends could get stopped out, and so the price undershoots to the downside.

The wheat market is not like a pond coming to equilibrium after you toss in a pebble. It can often be more like a pinball machine, with lots of automatic bumpers and actuators slamming the ball this way and that.

It should be noted that there is an important asymmetry between selling short and buying long. Short sellers have the risk of unlimited price rises, but can only make a finite amount when the price drops. They will therefore tend to be timid, and only enter for short periods of time.

There is no way to say that speculators make prices perfect—or make markets efficient—in according with the information they trade on. Unlike arbitrage, speculation cannot guarantee any particular market outcome. It involves numerous risks (sometimes lopsided), uncertainty, doubt, incomplete understanding, and many other challenges.

When reading any economics work (including mine!) you should strive to understand the meaning, nature, and consequences of the ideas. If something is said to be true, ask how that is so. Who would have to do what in order for it to be so? Look at real markets, and ask yourself is the theory working out in practice, or do you observe the exact opposite of what the theory predicts?

Sometimes a writer may not be as clear as he could be, especially if he thinks a relationship is obvious or takes a word or concept for granted. Other times, the problem may be that his choice of words is imprecise. No matter what, never fail to drill down, ask deeper questions, and look beyond the mere word to the truth of how markets work.

An efficient market is one which maximizes the marketability of the goods or securities traded in it. The higher the marketability, the lower the costs of doing business such as getting into and out of a good. An efficient market is one with the minimum possible spreads: bid-ask, geographic, calendar, brokerage commissions, etc.

An efficient market is not omniscient. The concept is closer to frictionless. A car with frictionless bearings does not guarantee you will drive to the right destination. It simply drives with the lowest possible fuel bill.

Minimum Wage Kills Goodwill

Seattle has imposed a $15/hour minimum wage.

Of course, this will kill jobs. It is basic economics: you cannot pay someone $15 to produce $10 worth of value. However, this essay is not about that. Nor is it about the impact on prices.

This essay is about the impact on goodwill. I am developing a series about the concept of goodwill. America once had lots of it. It is now being dribbled down the drain, dripping away, one drop at a time. This new minimum wage hike helps.

How?

This picture of a card helps explain. This may be just one angry dude, or it could be a big movement. I see it as another notch taken out of goodwill.

As with the cops and perps I wrote about previously, both sides have a legitimate gripe. Emotions are running high. And no one sees the merit in the other side, only in their own.

It’s the perfect toxic cocktail for killing goodwill all around.

Think on it for a moment. What cultural backdrop is necessary for a whole industry to pay near zero in wages, and workers earn the majority of their compensation from tips given voluntarily by total strangers? It is remarkable how much trust and goodwill must be there. This is not typical in the third world, and it was not typical through most of history.

Will people continue to tip, and tip generously, if they feel workers are overpaid? What if they feel that these workers lobbied the government to mandate their overly rich compensation? And suppose the patron resents that his favorite restaurants have closed, and now in any survivors, he pays a lot more than he used to.

Of course, the workers feel that they are falling farther behind, as real wages are lagging everything else in the economy. They resent their bosses for being too greedy, and they resent politicians for not setting the wage high enough. They are angry and resentful at lots of things, except the root cause: the failing dollar.

What do you get when you cross worker resentment with restaurant patron resentment?

We could be one coercive wage hike away from killing tipping in America.

The Great FreedomFest Debate Was Like Watching Tom and Jerry

With apologies to his fans, Jerry is an evil little mouse who constantly pesters Tom the Cat. Tom tries and tries, but cannot seem to overpower someone who is a fraction of his size and strength.

Watching Stephen Moore attempt to debate Paul Krugman was like that.

The “economics” of Krugman is Keynesian economics. It consists of central planning your life by force, because market failure. And Krugman repeated this phrase “market failure” several times. Of course the solution was always government intervention.

Here is an interesting endorsement about one of Keynes’ books.

“Fascism entirely agrees with Mr. Maynard Keynes, despite the latter’s prominent position as a Liberal. In fact, Mr. Keynes’ excellent little book, The End of Laissez-Faire (l926) might, so far as it goes, serve as a useful introduction to fascist economics. There is scarcely anything to object to in it and there is much to applaud.”

This was said by someone who knows all about fascism, Benito Mussolini. Fascism is a corporatist system. Although it has private ownership in name, it’s all under government control. Krugman is a real economic lightweight who proposed fascism for nearly everything that came up. His debate tactics consisted of context-dropping, asserting simple fallacies, and cherry-picking data.

In the TV cartoon, Jerry would steal something and run into his mouse hole. Tom would be left whacking at the hole with a broom, in vain. At FredomFest, Krugman would say that the government must spend more to get the economy out of recession. Moore disagreed, and Krugman displayed a chart showing government spending and GDP growth rates for many countries around the world. Government spending and growth correlated very well.

Instead of flailing away with a blunt instrument, I would have said “Seriously, Paul? What a simple fallacy. The definition of GDP includes government spending. You haven’t proven anything. It’s a tautology that if government spending goes up, GDP goes up. This is the flaw in GDP. Sometimes, rising GDP means the people are being impoverished.”

Next, Krugman moved on to one of the central fallacies of Keynesianism. In Krugman’s words, “You just gave the logic for government deficit spending. Your spending is my income. Where is the income supposed to come from, if everyone cuts spending? Government has to make up the difference.”

I would have said, “Seriously Paul. Again?! This is like the Broken Window fallacy [which Krugman said in 2011 “ceased to be a fallacy”]. Not all spending is consumer spending. Investment spending is important. When people slow consumption, it doesn’t mean they hoard dollar bills. They increase their bank deposits. Banks lend to promising companies. You know, that next new product or lifesaving technology? Except you don’t know it, because government spending has crowded them out.”

In an economic downturn, people go on fewer gambling and drinking binges to Las Vegas. Krugman is basically saying that the government has to take up the slack, and go on gambling binges. Because demand shortfall.

Shortly after telling Moore that one cannot cherry-pick one’s data, Krugman showed a graph comparing Jerry Brown’s California to Sam Brownback’s Kansas. For one year. I felt embarrassed for him, as there were sounds of amused laughter from the audience.

Why did it come to Kansas vs. California for the year 2014 (I didn’t write the year in my notes)? It’s because Moore was defending free markets by appeal to aggregate statistics. Moore used red states as examples of freer markets, and blue for less free markets. He showed a few charts in which red states fared better than blue.

Krugman’s cherry-picking got him safely back to his mouse hole, with Moore stuck outside, banging with a floor cleaning tool.

You cannot defend freedom using statistics, as you cannot get a mouse out of the wallboards with a broom.

Both Krugman and Moore were nervous speakers. Krugman was hunched a bit in on himself (though to be fair, he was in hostile territory and he knew it). Both spoke too rapidly and with a jittery character to their voices. Each has a nervous tell, with Moore incessantly taking little sips from his iced tea and Krugman playing with his fingers.

Krugman took the lead on each issue. Moore often respond with a long caveat, which conceded the point to Krugman. For example, Krugman said that some kids are born disadvantaged, so we need to give them each $8,000 to $10,000 (per year, I assume) in free money. He actually said they “choose the wrong parents.”

Someone please tell him that this is only possible by robbing the taxpayers. Maybe add that it will just accelerate America’s collapse into bankruptcy. Trillions in welfare spending do not fix anyone’s problems, and are actually the cause of the disadvantage Krugman discusses.

Moore said he supports a social safety net, because America is rich, we can afford it, and it’s morally right. When the broom failed to defeat the mouse, not even Tom tried singing to Jerry.

The topic moved to healthcare. Moore noted that government involvement has caused costs to spiral. Krugman offered another whopper. It’s because innovation.

This is absurd, and even Krugman knows it. In computers, there’s been decades of both rapid innovation and falling prices.

Krugman moved on to his shining moment, in the Ellsworth Toohey sense of shine. He unshrunk from his hunch, and his voice rang with moral clarity. “Obamacare is a life saver!”

The audience booed.

“I know someone whose life was saved by Obamacare. If you don’t know anyone like that, then I’m sorry for your narrow little world.”

This is a faux-apology and a presumption. Who the heck is this guy to apologize to me for my life not conforming to his ideology? Not to mention, Krugman glosses over the people harmed by it. There ain’t no such thing as a free lunch, even if handout beneficiaries think there is.

Worse yet Krugman implies that, to be moral, you must sacrifice yourself. He is cashing in on the guilt many people feel, at their own success. He’s learned that all he has to do is raise the specter that someone else is suffering, and they will concede him anything he demands.

This being FreedomFest, and not the People’s Workers’ Party, a large majority of the audience supported Moore. However, moderator Mark Skousen asked a very clever question, “If you did not enter this room in agreement with Paul Krugman, did you change your mind as a result of what he said today?” I estimate about 50 people clapped or cheered.

Krugman won because he appealed to people’s sense of right and wrong. Morality trumps economics any day of the week. Moore didn’t even respond to Krugman’s economic errors, much less smack down his phony judgmentalism.

How Could the Fed Protect Us from Economic Waves?

Mainstream economists tell us that the Federal Reserve protects us from economic waves, indeed from the business cycle itself. In their view, people naturally tend to go overboard and cause wild swings in both directions. Thus, we need an economic central planner to alternatively stimulate us and then take away the punch bowl.

Prior to the global financial crisis of 2008, a popular term described the supposed benefits created by the Fed. The Great Moderation referred to the reduced volatility of the business cycle. For example, I have written before about economist Marvin Goodfriend, who asserted that the Fed does better than the gold standard.

(Credit: Greg Ziegerson and Keith Weiner)

This belief is inherent in the Fed’s very mandate from Congress. The Fed states its three statutory objectives as, “maximum employment, stable prices, and moderate long-term interest rates.” These terms are Orwellian. Maximum employment means five percent of able-bodied adults can’t find work. Stable prices are actually rising relentlessly, at two percent per year. The meaning of moderate long-term interest rates must be changing, because rates have been falling for a third of a century.

That aside, the basic idea is that the Fed has both the power and the knowledge to somehow deliver an economic miracle. However, we know that central planning never works, even for simple things such as wheat production. Communist states have invariably failed to produce the food to keep their people alive. Stalin, Mao, and other communist dictators have deliberately starved off segments of their populations that they couldn’t feed.

The business cycle is vastly more complicated than the crop cycle. It plays out over decades. It involves every participant in the economy. It affects every price, including, especially, the price of money. It causes changes in how people coordinate in the present and how they plan for the future. And, there are feedback loops. Changes in one variable cause changes in others, which come back to affect the first variable. The very idea of centrally planning money and credit boggles the mind.

This should not be controversial. Yet, even those who know why government food planners fail, somehow retain their faith in central planning of the economy as a whole. Marvin Goodfriend—who spoke in favor of free markets, by the way—called his faith in central banking, “optimism.”

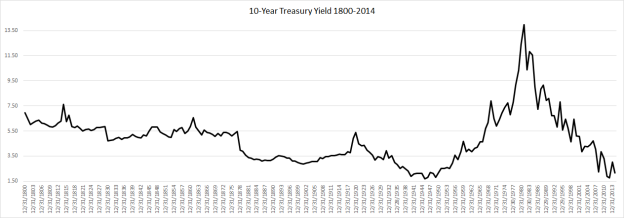

Is it true that the Fed is actually somehow providing stability, or even improving on a free market? Let’s look to the interest rate on the 10-year Treasury bond. The rate of interest is a key economic indicator.

With that giant peak on the right side of the graph, we can immediately reject all claims to Fed-imposed stability. Now let’s label a few key dates.

The pre-Fed period is pretty stable. Two spikes occur due to wars that we know disrupted the economy—and they’re pretty small, considering. Interest declines to a lower level when the government was paying down its war debt. Things remain stable until the creation of the Fed.

After that, we get a rise, a protracted fall, an incredible and truly massive rise, and an endless freefall. Both rising and falling interest make it more difficult to run a business that depends on credit, such as manufacturing, banking, or insurance. The post-Fed period is a lot less stable than the pre-Fed.

A feature of the free market and its gold standard is interest rate stability. The rate can vary between the marginal time preference and marginal productivity. This tends to be a stable and narrow range.

Fed apologists argue that the economy would be even more unstable, if we had no monetary central planner. However, the fact is that it became a lot less stable after the Fed was created.

This article is from my weekly column, The Gold Standard, at the Swiss National Bank and Swiss Franc Blog SNBCHF.com. I encourage readers who are interested to subscribe there, as I don’t plan to regularly post these articles here.